The real sector proved to be an excellent opportunity for the people who want to invest in real estate and earn passive income. Being multiple options to make from real estate, i.e. commercial, residential, multi-house, and many more, it records the highest number of investors( percentage being more in commercial real estate).

Despite this, the investors often overlook some specific investment options, making it quite tricky for the sections to rise. So here we present the list of investment options with great potential but often overlooked.

Commercial real estate:

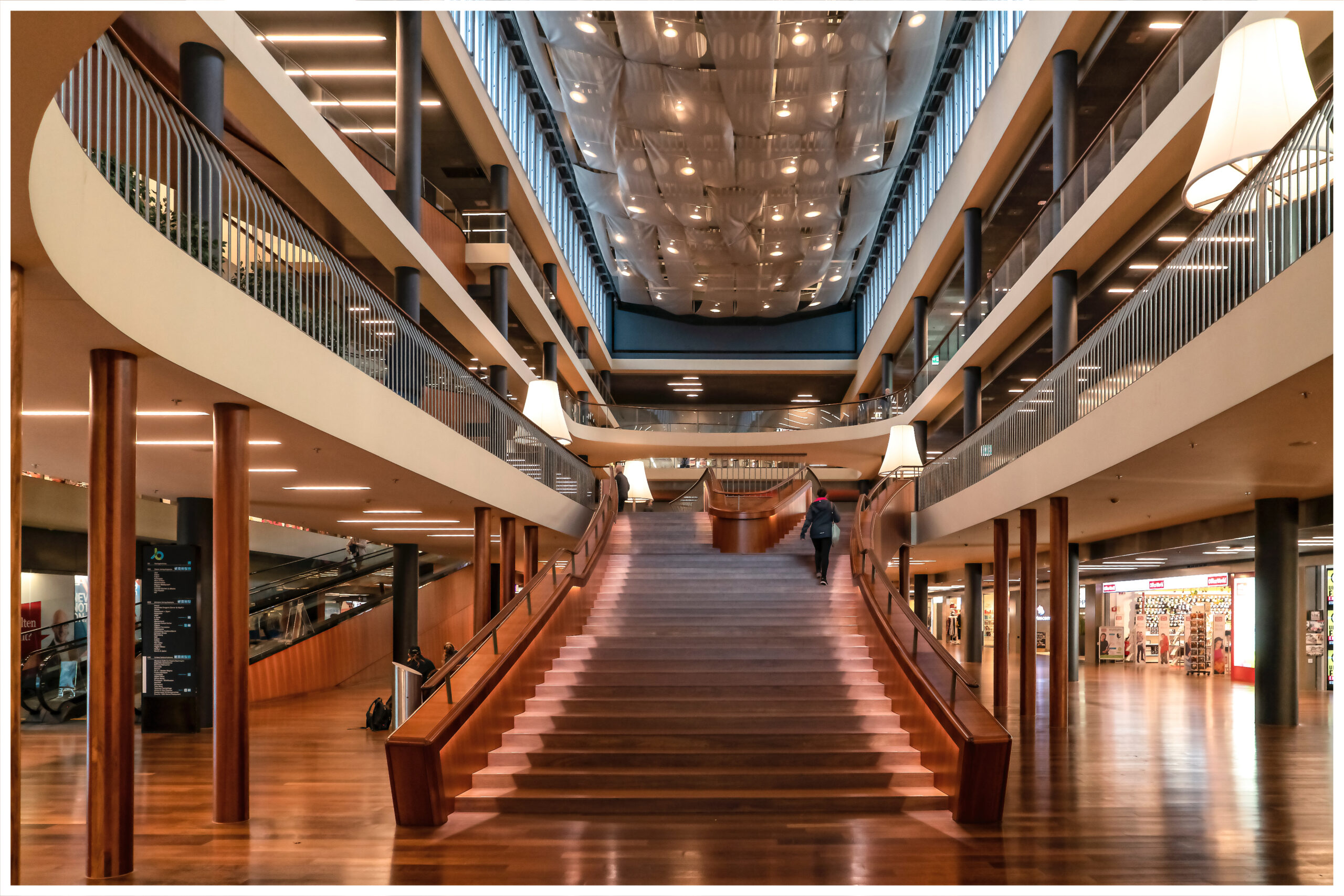

Commercial real estate is often considered as shopping centres, skyscrapers, and in some cases, warehouse and industrial complexes.

But have anyone ever considered mobile home parks and apartment buildings commercial investments? As the definition of the commercial estate is narrow, some property sections are often overlooked.

COMMERCIAL REAL ESTATE is defined as any property used mainly for business purposes. Some are rented out to tenants to conduct business. The range can go from gas stations to shopping centres and other spaces like hotels, convenience stores, restaurants, etc. But the definition holds more than that.

The difference between commercial and residential properties will help the investors understand the right investment place. Commercial includes assets that are generally taken under the residential option. There are retail real estate investors who take the opportunity to increase their investment even when the capitalization rate is high by multiplying the value.

Hence, check out the top 5 overlooked commercial investments offering excellent returns.

Multi-family properties:

Many view the apartment as residential real estate property, not the business. But multi-family properties must not be considered as residential investment options.

Having two-divisions residential and commercial multi-family, investors interested in purchasing residential multi-family properties finance the deal using a residential loan where the value is based on comps. This type of building includes 2-4 units based on family strength.

Similarly, the commercial multi-family is purchased using the commercial loan. The division is based on the strength of the staff required to run a successful business.

Location is often suburban, or urban areas prefer working-class people and students living away from their homes.

Self-storage:

Most investors also overlook this as a good investment option. Self-storage can be considered a significant commercial investment that highly rated groups often manage without separate classifications. The facility can be used either for personal or commercial purposes, as per the requirements.

Although the most popular, self-storage is overlooked as the best investment option, so if you are looking for sound choices, add self-storage to your list as the demand rises and you earn monthly rentals.

Mobile home parks:

Not commonly considered commercial property, but the well-learned realized that, after the pandemic situations fluctuations, it became imperative and beneficial as the demand rose. Still overlooked.

Therefore, it presents an excellent opportunity for the investors to benefit from the available situation and make the most of the investment.

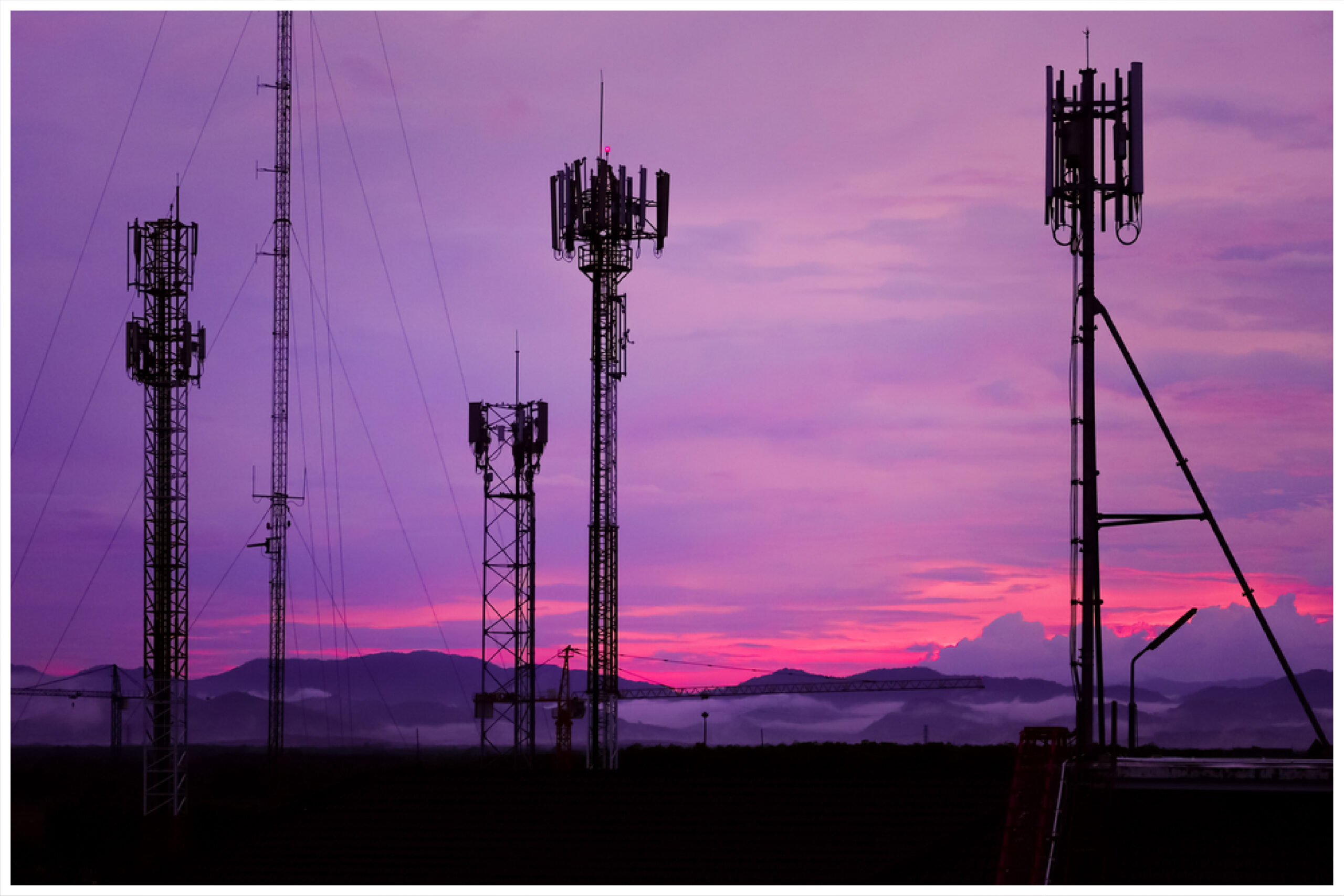

Cell towers:

The boom of cellular devices in the 2000s led the companies to search for new coverages, which came under the commercial real estate investment.

The best investment option is in rural dead spots, giving significant profits, with a steady income from the investment for the decades. All that the investors have to do is invest in a quarter acre of land.

The most convenient way to get the investment is to purchase someone else’s income stream with direct cash-out or invest in the idea of an active person.

The pandemic showed a drastic growth in the sector as the requirement of cellular data by the people increased day by day.

Senior living:

Senior living space demands are increasing every passing day. As most seniors fail to save money at a young age, they look for independent living communities like apartments and complexes.

The popularity of the sector makes it significant income for the investment. Trying investment in this section will bring positive results and ensure the availability of homes for seniors.